When it comes to protecting your facility, organization or business from cybersecurity threats and attacks, it pays to be covered in the event of a malicious event. No matter how complex your IT footprint, if you suffer a data breach, your organization will be required to dig deep in their pockets to pay thousands, if not millions, of dollars in resulting expenses. However, with a cyber insurance policy, you can reduce that risk and continue to protect your organization from unwanted ransomware or cybersecurity breaches.

As a leading cybersecurity service, we know that as valuable as cyber insurance policies are, they can be costly. However, the right mix of cybersecurity defenses will allow you to demonstrate to your insurance company that you have taken precautions, which can ultimately result in discounted premiums.

At TREBRON, we’re a cybersecurity service whose our goal is to help protect your organization’s sensitive finances, data and information. Keep reading to learn about the benefits of cybersecurity and see how you can achieve great savings on the cost of your cyber insurance premiums.

What is Cyber Insurance?

Also known as cybersecurity insurance or cyber liability insurance, cyber insurance is a policy that organizations can purchase to help reduce the financial risks associated with managing critical data and infrastructure. In exchange for the cost of the policy, the insurer assumes some of the liability of cyber attacks, ransoms and other malicious events. Similar to a property insurance policy, it is typically renewed on an annual basis.

When you experience the theft, compromise or loss of your electronic data or sensitive information, your business might be at risk of losing revenue and customers. You might also be held responsible for any damages stemming from the cyber or ransomware attack. Therefore, it’s important to have cyber insurance coverage to protect your business against this risk and help to cover the costs associated with remediation, including payment for crisis communicators, investigators, legal assistance and customer refunds or credits.

Keep in mind that all businesses or organizations that create, store and manage data online or maintain electronic records such as credit card numbers, customer sales and customer contacts can benefit from a cyber insurance policy and the liability cover that cyber insurance provides.

Ways to Save on Cyber Insurance

Without cyber insurance, you can expect to pay a significant amount should you suffer a data breach and need to pay all the resulting expenses. With cyber insurance, liability limits can range from $1 million to $5 million or more, thereby covering a good chunk of damage.

According to Brian Mahon, a cyber insurance expert with EHD Insurance, “An investment in smart cyber defenses can save an organization big on their premiums. In fact, we have seen underwriters reduce premiums by anywhere from 10% to 30% when they see strong, documented cybersecurity implementation within the applying organization.”

If you’re looking to reduce the cost of your cyber insurance coverage, there are a number security controls that can help to lower your premium — and are required by many policies for any coverage — including the following:

- Deploy Endpoint Detection and Response (EDR)

EDR detects and protects against brute force attacks, backdoors, trojans, viruses, rootkits, malware, ransomware and unknown threats. As a result, several cyber insurers explicitly mention endpoint protection as a critical prevention measure. Learn more about EDR solutions here. - Implement a Cybersecurity Training Program

A good training program should inform your employees about spear phishing, email phishing and other common threats and attacks, thereby showing cyber insurers that your business is focused on high security. Learn more about cybersecurity training programs here. - Use Multi-Factor Authentication (MFA)

MFA signals to cyber insurers that your organization is less of a risk since MFA requires you to use multiple forms of authentication and makes it harder for attackers to use stolen passwords. Learn more about MFA here. - Review NIST Alignment

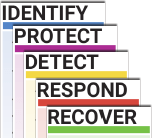

When your company is aligned with NIST best practices, cyber insurers view your operation as less risky and are more likely to offer you a reduced premium in exchange. TREBRON can analyze your business, ensure you are following NIST standards and recommend the right software and hardware to eliminate vulnerabilities. Learn more about our cybersecurity assessments here.

Keep in mind cyber insurance is relatively new to the industry. Because of this and the ever-increasing number of successful cyber attacks and resulting increase in claim payouts, this list is constantly evolving. Each year, insurance providers are raising the bar for customers.

Without cyber insurance, your organization will be responsible to cover the costs and risks associated with a data breach. TREBRON is an expert cybersecurity service that can help you review your existing policy and implement key technologies and processes that will not only reduce your risk of an attack but will also dramatically lower your insurance premiums.

Ready to Learn More?

At TREBRON, we’re committed to helping schools, businesses and organizations of all shapes and sizes protect their data, employees and customers. If you’d like to learn more about how we can evaluate, recommend and implement a security solution for your unique application, contact us today for information. We look forward to hearing from you!